NSF GRANT ACCOUNTING AND PAPPG EXPERTS

The terms and conditions embedded in NSF SBIR Grant Funding Awards create special problems for for-profit businesses.

If you’re a for-profit business with an NSF grant, you must comply with the Proposal & Award Policies and Procedures Guide (PAPPG), which requires Federal Acquisition Regulation (FAR) Part 31 accounting.

The National Science Foundation was created by Congress in 1950 to promote the progress of science. Today, the agency uses an annual budget of $8.3 billion (FY 2020) to initiate and support scientific and engineering research, issuing approximately 12,000 grants a year for an average duration of three years.

THE NSF PAPPG CREATES A UNIQUE CHALLENGE FOR GRANTEES.

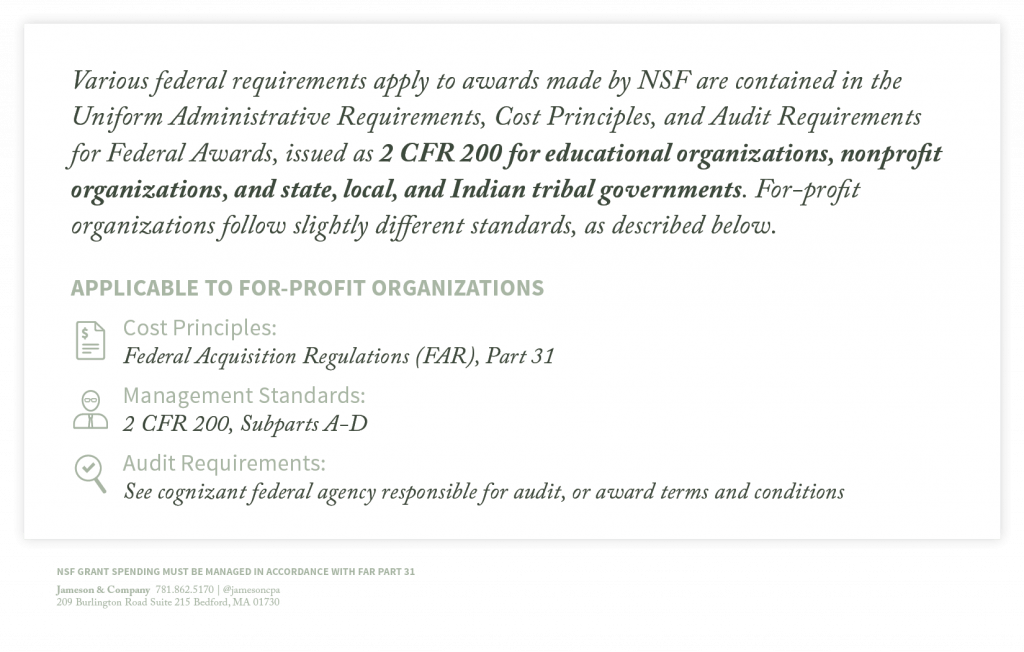

The vast majority of NSF grant funding goes to colleges, universities, and hospitals, so the rules and regulation that stem from 2 CFR 200 are written for non-profits. To make it clear that these regulations also apply to for-profit awardees, the NSF tried to provide clarity by issuing the paragraph below.

FOUR KEY TAKE-AWAYS FROM THE NSF PAPPG EVERY FOR-PROFIT, PHASE II NSF GRANTEE MUST KNOW.

1. The Representations and Certifications you sign before receiving your Phase II funding may be used against you!

- You receive a fixed price Phase I SBIR award from NSF, giving the government no rights to review your accounting records.

- Before you get a Phase II award, the NSF Cost Analysis and Audit Resolution (CAAR) Branch Auditor will ask to see that your Phase I spending was made in accordance with FAR Part 31. This requires you to produce a report on your phase I spending as if the award were a cost-type funding vehicle. If you fail to produce this reporting correctly, you will not receive your phase II funding.

- In order to pass the CAP audit, which is necessary to obtain Phase II funding you must certify that this is how you keep your books and records.

- Your Phase II SBIR NSF grant funding award will say that it’s a fixed price award. This may lead you to believe that you no longer need to maintain a FAR Part 31 accounting system. This would be a huge mistake – given that you certified that you maintain a FAR Part 31 accounting system before you received the Phase II!

2. You will not be audited during the performance of your Phase II award… and that’s not a good thing.

With other agencies, an audit gives the awardee the chance to make things right if there was a mistake. The lack of audit oversight can create a false sense of security.

3. Within 90 days of your grant’s expiration, you must file a Final Spending Report in order to collect your final $150,000. This is when the trouble begins!

When your grant is over, you must prepare a Final Spending Report. Any funding not spent “properly” must be repaid based on the agency’s analysis of this report.

With other agencies, an audit gives the awardee the chance to make things right. With NSF grants, problems in the Final Spending Report can trigger an immediate investigation by the Inspector General (IG)* and fast track to criminal prosecution under the False Claims Act.

For more details, read our blog on this subject.

4. Jameson’s NSF Compliance Solution

Obviously, your best course of action is to avoid trouble by staying compliant. To help, we’ve created a comprehensive solution for for-profit NSF grantees which includes:

- FAR Part 31 Compliant Accounting Set Up using QuickBooks Online and JamesonWorx

- One-On-One training

- Monthly Phase I Accounting Services

- Review of the cost portion of your Phase II Proposal

- Help you respond to the NSF Request for Ratios prior to CAP Review Audit.

- Cost Analysis and Audit Resolution (CAAR) Audit Representation

- Monthly Phase II Accounting Services

- Assistance with Final Cost Report preparation

- Represent you with any Inspector General inquiry (if necessary)

GET STARTED WITH JAMESON’S NSF Compliance SOLUTION

Fill out the form and one of our government funding experts will be contacting you within 48 hours.