How to Tweak QuickBooks for SBIR and DCAA Compliant Accounting

QUICKBOOKS ON ITS OWN IS NOT ADEQUATE FOR SBIR AND DCAA COMPLIANT ACCOUNTING

As we speak around the country about the nuances of Government Grant and Contract accounting, we are constantly asked “is QuickBooks an acceptable accounting system?”

The short answer is – no, not out of the box. However, this blog will discuss how we, at Jameson & Company, make QuickBooks Online become Federal Acquisition Regulation (FAR) compliant.

In our last blog, we mentioned what your accounting system must do to be FAR-Compliant:

- Segregate direct, indirect (F&A) and “unallowable” costs

- Accumulate direct costs by contract/grant budget category

- Allocate indirect costs (fringe and F&A rates) to intermediate and final cost objectives based on a “logical and consistent method”

- Reconcile the job-cost ledger with the general ledger

- Track employee time by job activity

- Charge direct and indirect labor costs to the appropriate accounts

- Produce monthly reports of charges to contracts & grants to support billings/draw downs

- Exclude unallowable costs to avoid billing them to the government

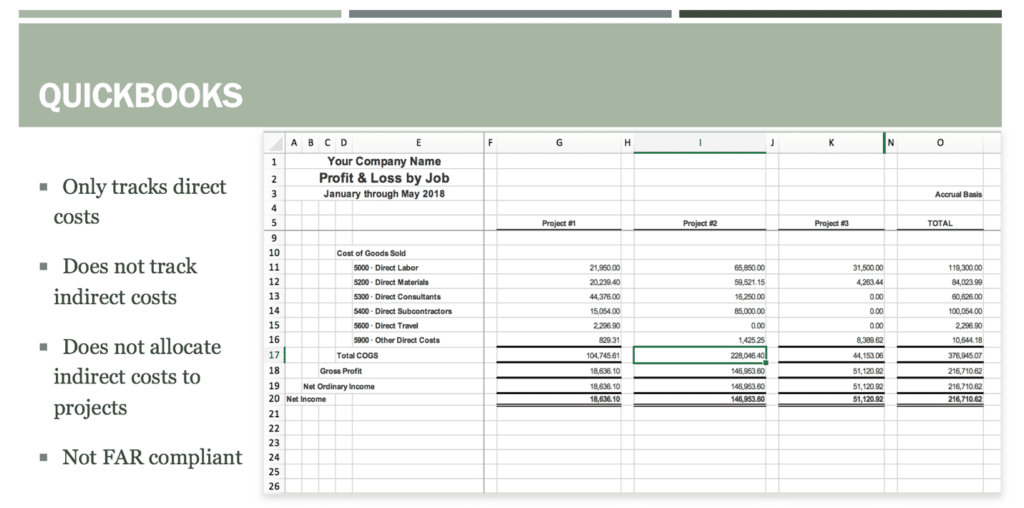

By itself, QuickBooks does some of these things very well. However, three of the most important items can’t be done by QuickBooks without a little help. The picture below is a fairly typical looking QuickBooks Job Cost Report. An accurate Job Cost Report (a.k.a. a backlog report) is a critical report for proper SBIR accounting.

The following chart details where QuickBooks is OK and where it falls short.

| FAR COMPLIANT ACCOUNTING REQUIREMENT | IS QUICKBOOKS OK – YES OR NO? |

| Segregate direct, indirect and “unallowable” costs

| Yes – QuickBooks Chart of Accounts can be set up do this easily. |

| Accumulate direct costs by contract/grant budget category

| Yes – QuickBooks does a beautiful job of this as long as you charge expenses properly when coding activity. |

| Allocate indirect costs to intermediate and final cost objectives based on a “logical and consistent method”

| No – QuickBooks does not do this, and this is a critical requirement. We’ll talk about how to fix this later in this blog. |

| Produce monthly job cost reports – charges to contracts & grants which support government billings/draw downs

| Yes (with some help from Excel) – A job cost report can easily be created using Excel as a “subsidiary” ledger. |

| Reconcile the job-cost ledger with the general ledger

| Probably not – Maintaining an error-free subsidiary job cost report that reconciles back to QuickBooks can be tricky for someone without an accounting degree, so checks and balances are typically necessary. |

| Exclude unallowable costs

| No – This must come from a CPA with expertise in the DOD FAR Part 31 rules, NIH 45 CFR Part 75 regs and the NIH Grants Policy Statement, as well as DOE 2 CFR 910.352 Cost Principles. |

To make QuickBooks SBIR-Compliant we need to fix the 2 “No’s” and the “Probably Not”. Let’s deal with the “probably not” first.

Reconciling the job-cost ledger with the general ledger

One of the most important aspects of maintaining an accurate job cost report is the distribution of labor costs. As an example, an employee making $80,000 would distribute $40/hour to a project/job as a direct labor charge assuming 2,000 hours in a year.

The most common reconciling item surfaces when someone (hopefully not a government auditor) realizes that most employees are recording more than 2,000 hours/year on their timesheets, so they are making less than $40/hour, but you are charging the government $40/hour.

We’ve written a blog series on how to handle the technical issue known as “uncompensated overtime” so we won’t beat a dead horse here, but you may want to check out our uncompensated overtime blog series.

Distributing Labor Costs

One of the largest cost elements of a typical project is direct labor. And the government has noticed. The FAR requires you to create a written timesheet and labor distribution policy and follow it! Most of the PhD’s, scientists and engineers that we work with didn’t go to college to study accounting but find this concept pretty easy to understand and pretty easy to mess up unless there are checks and balances in place to make sure that it’s being done accurately every month.

In fact, more than 80% of our clients have us distribute the labor costs into their general and subsidiary ledgers for them. Why? Because the government requires that you maintain an accounting system with labor costs distributed into the books on an accrual basis of accounting and create a report reconciling those costs to your cash-basis payroll tax returns. Someone with an accounting degree and less than 5 years of experience can easily write checks and reconcile cash. However, distributing labor costs and reconciling them to the payroll reports using different account methodologies is tricky and probably out of their pay grade.

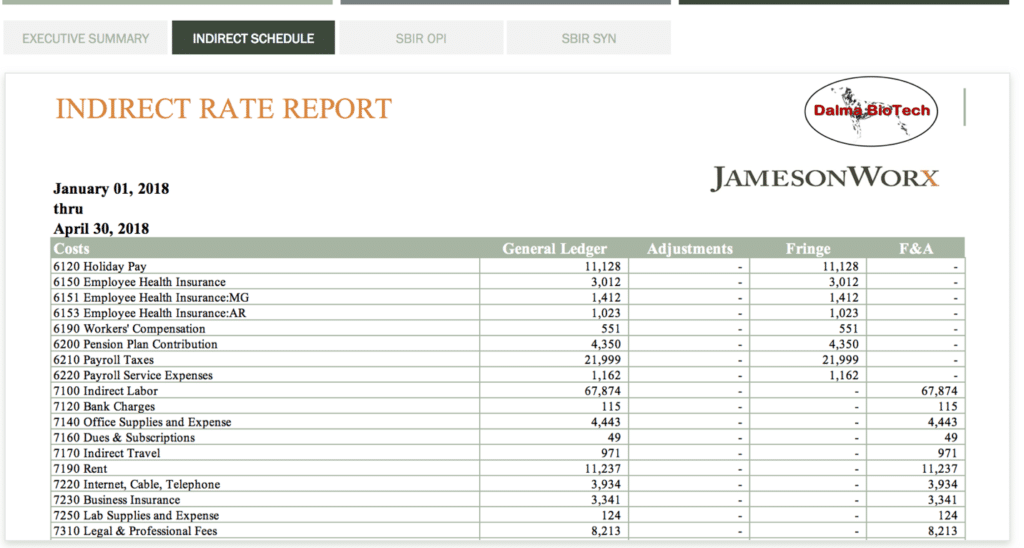

Indirect Cost Rate Calculation

So let’s discuss how to fix the first QuickBooks “no” – Allocating indirect cost rates based on a logical and consistent method.

The second critical report that you need to be able to produce on an ongoing basis to demonstrate a FAR-compliant accounting system is an Indirect Cost Rate Calculation. It’s standard operating procedure for a government auditor to know the indirect rate you bid in your funding proposal to ask you how your ACTUAL indirect rates are running so they can confirm that you aren’t overbilling the government.

We take a deep dive into the topic of indirect cost rates during webinars, so we won’t get into it here. However, you can register for a live webinar (where you can ask questions) or watch a recorded webinar, or watch our 5 video series to better understand indirect rates by clicking here.

The bottom line is that the QuickBooks Chart of Accounts can be set up to capture the information needed to produce an indirect rate calculation report. However, the accuracy of this report (and the job cost report) will never be OK, if we don’t address the real issue…

You need more than just a software solution!

The NIH Salary Cap

We’ve alluded to it a bit above, but if you don’t know the NIH Salary Cap without looking it up, you’re probably using Google as your go-to source for information. What could go wrong?? Seriously?? Follow us on Twitter and LinkedIn where we share articles on indictments, arrests, fines and the occasional fraud and jail sentence about once a month.

Grants are subject to Uniform Guidance Audits

You need a subject matter expert to oversee your team (or be your team) to make sure you’re coding activity correctly, key numbers reconcile, checks and balances are in place, and most important, you have someone to rely on to represent you and your accounting system and records when the government auditors or Uniform Guidance Auditor (UGA) appear.

JamesonWorx

In our last blog we discussed why we developed JamesonWorx. There are three critical aspects to JamesonWorx that work in concert to allow you to have the most cost-effective SBIR Compliant accounting solution for awardees with an annual revenue of less than $10 million per year:

- QuickBooks Online (QBO)

- Jameson & Company’s 40-plus years of experience in government grant and contract procurement, award management and audit support.

Here’s a step-by-step look at how, JamesonWorx, handles SBIR accounting.

JamesonWorx is a complete solution with four distinct service levels. Most importantly, it’s a game-changer for our small business clients. This is how our process works:

- Jameson sets up your QuickBooks Online chart of accounts in a FAR-compliant manner and enables all active award budgets in the job cost reporting system.

- Next we enable all command and control dashboards for you to track your projects and indirect cost rates – including fringe and F&A rates for NIH grantees; or fringe, overhead and G&A rates for DoE and DoD contractors and grantees, or whatever combination is right for your business.

- Jameson provides your designated financial liaison with three hours of training (unless you choose our Enterprise package, in which case you will outsource your accounting to us, and we’ll take care of everything.)

- Jameson connects your QuickBooks Online file to JamesonWorx – our proprietary data model that creates all the basic reports needed to be FAR part 31 compliant.

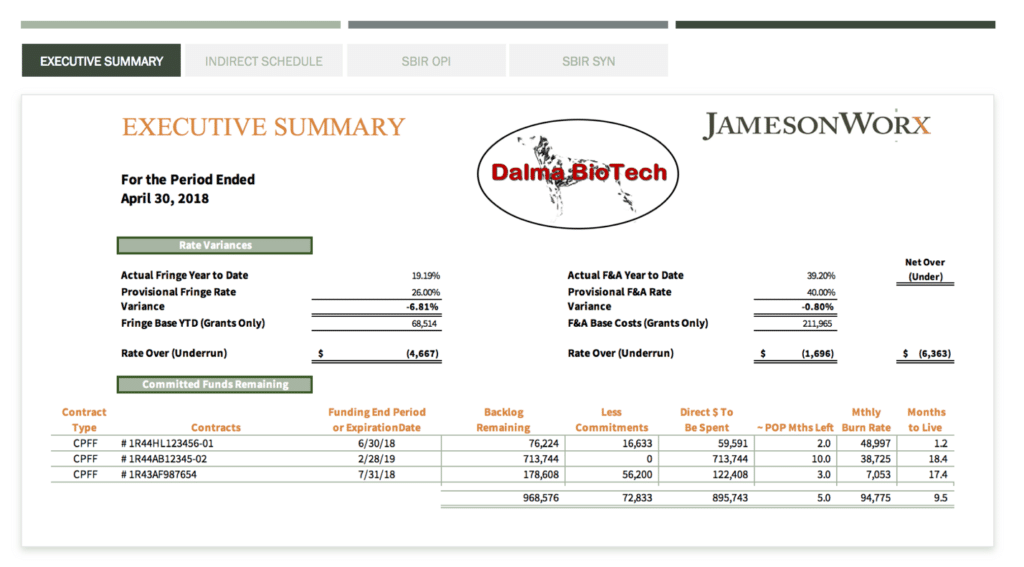

To help you see why these matter, here are some reports to study. In this first report, JamesonWorx automatically creates an indirect cost rate calculation for a fictitious company called Dalma BioTech:

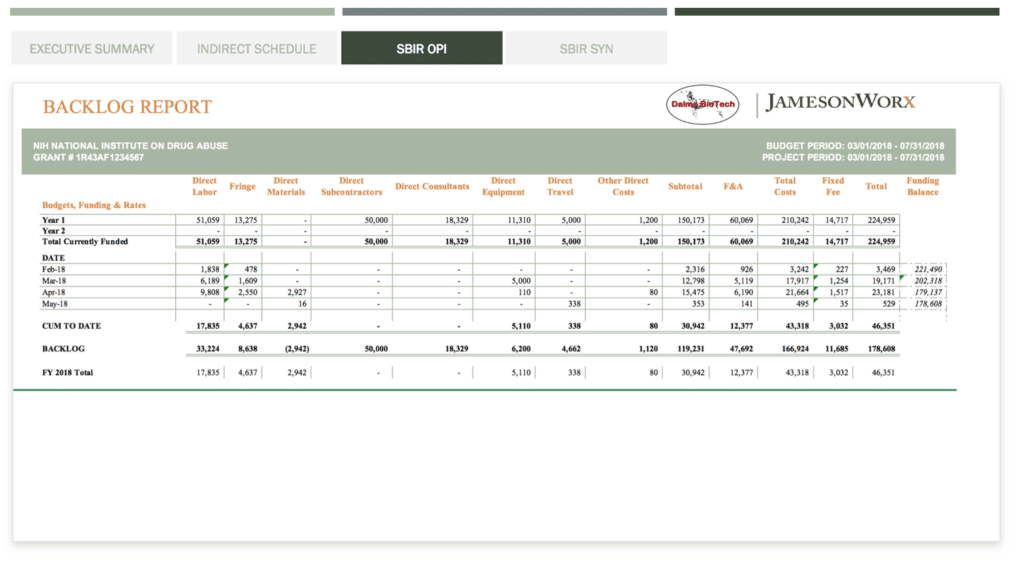

Next, here is a simple job cost report for an NIH Phase I. Our clients refer to is as a “backlog report” rather than a job cost report (it does both) because now that they know that their accounting system is running properly, they stop focusing on accounting and focus on how much work there is to do and how much funding is left.

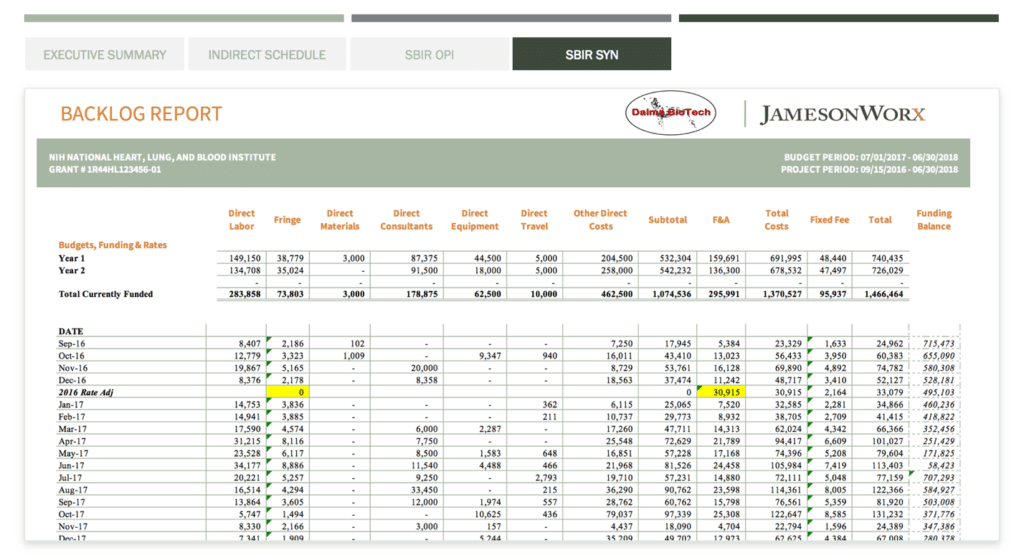

In this next multi-year Phase II example, we allocate the F&A rate overrun (in yellow) to each project proportionally, as required by the FAR:

We’ve even created executive dashboards, in case you’re only interested in key indicators.

Of course, if you have questions or need more help, Jameson CPAs are a phone call, email, Zoom call, car ride or flight away. It’s critical to understand that FAR compliance isn’t just a software solution. You need to align yourself with a CPA with deep industry expertise.

We’ve been in business since 1978, have clients from coast-to-coast, and over $6 billion in awards managed. We know the agencies and regulations—and how to help our clients avoid audit findings. And now, we have a complete solution, JamesonWorx, that will help you stay FAR-compliant and avoid trouble.

Speak With A Government Funding Award Expert!

Call Toll Free: 833-415-3900 – or – Schedule A Call

Want to learn more? See our full description of JamesonWorx solutions.

I’ve been in practice for over 40 years helping our small business clients procure, manage, and survive audits on more than $6 billion in federal government contract and grant funding. We’ve been featured presenters and panel moderators at Tech Connect’s National SBIR/STTR conferences since 2010, and I’ve presented at the DOD’s Mentor Protégé Summit and present regularly for several state and local organizations.

GET THE SOLUTION YOU NEED NOW

Learn more about how we can support your needs and objectives. Join us for an enlightening discussion and take the first step towards a partnership that can make a difference.

JOIN OUR NEXT WEBINAR

Join us for an upcoming webinar where we’ll dive deep into the latest insights and strategies.

Reserve your spot today and take a step toward gaining valuable knowledge that can make a real impact.