Important Accounting Practices for NSF Awardees

We’re very pleased to have with us today Ed Jameson who will be leading the webinar for us today.

Ed Jameson is a CPA and the managing member of Jameson & Company. He’s the second generation CEO of Jameson & Company, and you could say that government grants, contracts, audits, and protecting clients are in Ed’s blood. After serving as a senior consultant in the small business and tax departments at Price Waterhouse Boston, Ed joined the firm in 1988. Since then, he’s helped clients secure, account for, and survive audit on more than $6 billion in government grants and contracts.

Ed has negotiated thousands of indirect cost rate agreements and government audits. He consults on cost recovery, strategic and tactical management issues, and contract and grant procurement. In addition, he oversees all client relationships. Ed enjoys educating and entertaining an audience and has been a featured speaker at the National SBIR Conference for years.

ED: It’s a privilege today to just talk about NSF awards because typically when I do this in a bigger forum it can be confusing because you’ll have NIH grant winners, DoD contract winners, and DOE grant and contract winners. Hopefully where we are solely focused on NSF – today will be a little bit clearer.

Today, we’d like to:

- Give you a broad overview of the strings attached to the Phase II award that you’re hoping to win

- Discuss the details about your cost proposal and the Cost Analysis and Pre-Award (CAP) process

- Budgetary review

- Accounting system review

- Financial capabilities review

- Talk about how Jameson & Company can help you

NSF PHASE II AWARD. A BRIEF OVERVIEW

An NSF Phase II award is a predetermined fixed award. Years ago, my partner Brian LaCroix and I would look at these and we’d go, well, these are fixed price awards. I don’t know that we can really help people with these. Over time, we’ve learned that we actually can help people quite a bit.

NSF’s grant mechanism is very similar to what the government awards to non-profit organizations. These organizations negotiate from prior year history, and that’s what the NSF does.

A Phase II is typically a $750,000 predetermined, fixed award. However, if you do not budget properly, the budget will be reduced from $750,000 down and, as you’re going through the award, if you don’t monitor, track and report your costs correctly, the money can be pulled back away from you.

KNOW FAR PART 31 & ARTICLE 14 OF NSF’S SBIR TERMS AND CONDITIONS

There are a couple of clauses that you need to know. One is Federal Acquisition Regulations or FAR Part 31, which is the allowable costs clause and defines what the federal government will and won’t pay for.

The other is Article 14 of the NSF SBIR Phase II award terms and conditions that talks about project reporting requirements. There are interim and final reporting requirements and later I’ll talk about the final report, which is when you suddenly find out that if your accounting is wrong, you have “defectively pricing your proposal”, and the government claws money back at the end.

In order to avoid issues and stay out of trouble, it’s critically important that you budget properly, you track your accounting costs properly, and report properly.

With all that said, I’m going to turn the stage over to Caroline Crosby, to talk about the nuts and bolts.

PREPARING FOR NSF’S SBIR PHASE II – CAP REVIEW.

ED: Okay, let’s dig into some details. So just like an astronaut prepares to go into space by going through some checklists, the NSF wants you to be prepared for what’s going to be the CAP review of your proposal. They give you not one, but two checklists as a guide for compiling the information for your submission.

NSF’S SBIR PHASE II CAP CHECKLIST SECTION B: EXPENSES AND SUPPORTING INFORMATION.

We’re going to start with talking about your direct expenses; that’s Section B on the checklist, and it’s called the Information to Support the Budget Review.

At this point, you’re going to be painfully familiar with the line items of your proposal. The first one is your direct labor costs. Your direct labor costs will consist of:

- existing employees

- personnel to whom an offer may have been extended

- people who are to be hired.

For an existing employee, the submission asks you to include payroll reports to support their hourly rates. If there’s personnel to whom you’ve extended an offer, you will need to submit the job offer letter. Finally, if there are personnel still to be hired, you will have to support the requested salary with approximate salary data as published in the Bureau of Labor Statistics.

THE NSF PHASE II CAP REVIEW AND TIMESHEET POLICIES

Now this should not be a surprise to any of you, especially if you’ve gone through Phase I training: You’re going to be asked to include supporting documentation for your timesheet policy in your submission. This policy needs to say:

- Timesheets are filled out daily in ink

- All employees who charge their time directly or indirectly to the government award, will record all their time.

- Timesheets are signed by the employee and their supervisor

- There is no erasing. All changes must be crossed out and initialed.

INDIRECT COST RATES AND THE INFORMATION TO SUPPORT THE BUDGET REVIEW

Another component of your budget is your indirect cost rates. Many clients miscalculate this in their Phase I. They may not have thought about fringe costs, administrative time, business insurance, all many other common indirect costs.

NSF and the 50% SAFE indirect cost rate

What you’ve probably learned is that NSF will give you an indirect cost rate of 50% of your direct labor without question, meaning that no supporting documentation will be required during the CAP review.

If you need an indirect cost rate that’s greater than the 50% safe rate, it must be substantiated. A negotiated indirect cost rate with another agency will be helpful in supporting a rate greater than the 50% safe rate, but NSF reserves the right to adjust for any agency differences.

KEY POINT: The indirect cost rate is capped at 150% of direct labor for NSF.

NSF negotiation starts with prior actual information. Submitting projections isn’t going to help you. Critically – you’re allowed to re-budget from indirect to direct expenses. However, the opposite is not true. You’re not allowed to re-budget from direct to indirect expenses. So to provide yourself with the maximum amount of flexibility in your budget, go for at least that 50% rate.

PROPOSING A 7% FEE TO COVER UNALLOWABLE EXPENSES

NSF allows a 7% fee on your Phase II SBIR; 7% of $750,000 is $49K, and that $49K can be spent on whatever you want, including unallowable expenses such as sales, marketing, business development. Don’t leave that out!

SUBMITTING OTHER TYPES OF DIRECT COSTS

You’re also required to compile and submit supporting documentation for other types of direct costs that are in your proposal.

- Direct consultants

If you have direct consultants, then you have to submit a consulting agreement, which includes an hourly rate for your consultant limited to $75 per hour, a detail of the scope of work, and your consultant’s qualifications.

- Direct materials

For direct materials, you must provide a list of the materials and supplies, and include a description of the supply, the quantity, the price, and the vendor that you’re going to be using. If you have direct equipment or materials that exceed $5,000, you must submit three written price quotes.

JOB COST REPORT

Another section of the checklist requires a job cost report.

When accumulating costs on your Phase I SBIR award as you’re processing transactions, you must be sure to post activity properly.

The consultant’s invoice must detail the number of hours worked and a description of the work performed. Your direct materials need to be supported with documentation that’s properly coded with the general ledger account number, with supporting payment that’s in alignment with the invoice. Make sure you’ve properly coded expenses to your SBIR Phase I.

If you have direct travel in your submission, the $2,000 per participant for the NSF conference requires no substantiation, and there’s a limit of two people or $4,000 in your proposal.

Otherwise, you must provide a detailed breakdown and itemization of the travel in the CAP review.

The submission requires a statement substantiating information for each subcontractor. You must inform NSF about the type of relationship you have with the subcontractor – whether the subaward was sole-sourced or competitive, and whether the award is intended to be fixed price or cost reimbursable. You must submit subaward budget justification, and if your subaward is with a university, you’re going to have to include that university’s negotiated indirect rate agreement. All this information needs to be reported even though you may not have an executed subcontract agreement.

It’s very important to note that when you have an agreement with a subcontractor and you get a government award, all of the FAR provisions that you are subject to must flow down to the subcontractor.

All of that was regarding matters that are addressed in the checklist section B.

NSF SBIR PHASE II CAP CHECKLIST SECTION A – FINANCIAL INFORMATION

You’re required to demonstrate that you have an acceptable accounting system in place.

First, you want to make sure that your general ledger segregates your direct costs, indirect costs, and unallowable costs.

You also have to have evidence of a project costing system; you have to have evidence that you’re capturing any restrictions that are on your award, and that you have effective internal controls to monitor the information that you’re processing through your accounting system. How do you handle expenses that are not in the original proposal? Do you have something in place for that?

Re-budgeting is different for different agencies. NSF allows you to re-budget up to 10% of costs without permission, except – you cannot re-budget from direct to indirect costs.

Do you know how to characterize each of your transactions?

A lab jacket: direct or indirect? Well, it depends. If we talk to a client and they are using a lab jacket for one procedure that’s specific to only one award and that lab jacket is no good after you’re finished with the procedure, that’s a direct expense. You have to understand the character of each transaction.

There are more questions to ask yourself:

- Have you been thorough with your indirect expenses?

- Have you budgeted for your employee benefits, medical insurance, retirement plans?

- Do you understand any limitations that are imposed by the Federal Acquisition Regulation? Rent, for example, could be limited. If you’re renting from a related party, you need to go through a complicated calculation to understand how much of the rent is an allowable expense.

- Are you screening for unallowable costs?

- Are your accountants and attorney fees all 100% allowable? Unless it’s specifically negotiated in your award, costs related to patents, licenses, royalties are generally unallowable expenses.

Bottom line: You need to have somebody who’s processing the transactions who understands what’s allowable and unallowable, knows the limitations of the FAR, and understands how to properly code transactions.

MAKING SURE YOU’RE READY FOR AN SBIR PHASE II NSF AUDIT

In the audit, there are several other matters that you need to prove are in place to the NSF auditor.

GAAP financial statements

The financial statements must be prepared according to Generally Accepted Accounting Principles, or GAAP. That means that they need to be prepared on an accrual basis, and you have to adhere to such regulations as capitalizing and depreciating fixed assets.

If you have QuickBooks and your software is set to cash basis, those statements have to be adjusted so that when you present them to the NSF as part of your CAP review, they are now on the accrual basis.

Tax returns reconciled to your financial statement

One of the checklist items is to submit two years of your tax return and reconcile them to the financial statement. When you have your tax return done, get that supporting documentation from your tax preparer, and be sure not to change your software after the year is closed.

Demonstrate solvency

You must demonstrate solvency via several key financial ratios. The NSF says to compare your current assets to your current liabilities and compare your liquid assets to your current liabilities. This provides an indicator about whether you have enough cash to pay your bills. If, you show indicators of financial difficulty, you will need to prepare additional documentation to give reassurance to the NSF that you’re going to be able to stay alive as a going concern throughout the life of your award. They may ask you to provide a two-year cash flow projection. They may also ask for details of any additional investments or contracts that you may be counting on to come in over the next two-year period. They’ll ask for financial letters of support and anything else that you have that supports the company’s ability to continue.

HOW DO YOU KNOW IF YOU HAVE A FAR PART 31 ACCEPTABLE ACCOUNTING SYSTEM?

ED: What I like to do now is help people figure out whether you have an acceptable accounting system or not

Proof point 1: Can you show a job cost report

The first thing that I like to do is ask, “Can you show me your job cost reports?” If your accounting system produces a job cost report that tracks all of your actual spending just like it was in the budget, that’s a good sign.

Proof point 2. Do you know how your indirect rate is running?

One of the things that you do in your budget is you project an indirect rate, and let’s say that you use 50%. My question to you is, “Do you know how your actual indirect rate is running? “

This is typically when I get stared at when I speak live. I joke with people, I don’t need to talk to you in the hall. If you can’t tell me what your actual indirect cost rate is, your accounting system is not okay. It’s an incredibly easy test.

MAKING QUICKBOOKS A FAR-COMPLIANT ACCOUNTING SYSTEM

I’ve actually gone back and listened to NSF’s webinar, and I find some of it to be quite good and some of it to be really incomplete, to be honest with you.

One of the things that they talk about is using QuickBooks in order to establish your general ledger and your accounting system. The problem with QuickBooks is, even if you set it up correctly, then run a job cost report, you will only get direct expenses. There are no indirect expenses being tracked or allocated to the projects.

QuickBooks as a stand-alone product is not a FAR-compliant accounting system.

We never wanted to develop software. We’ve tried all sorts of different packages, and Deltek and Unanet are great. But, they are super expensive and they’re super complicated. And all of the lower end stuff that we tried either doesn’t have enough users or is poorly designed architecturally.

THE GENESIS OF JAMESONWORX. A FAR-COMPLIANT ACCOUNTING SYSTEM USING QUICKBOOKS ONLINE

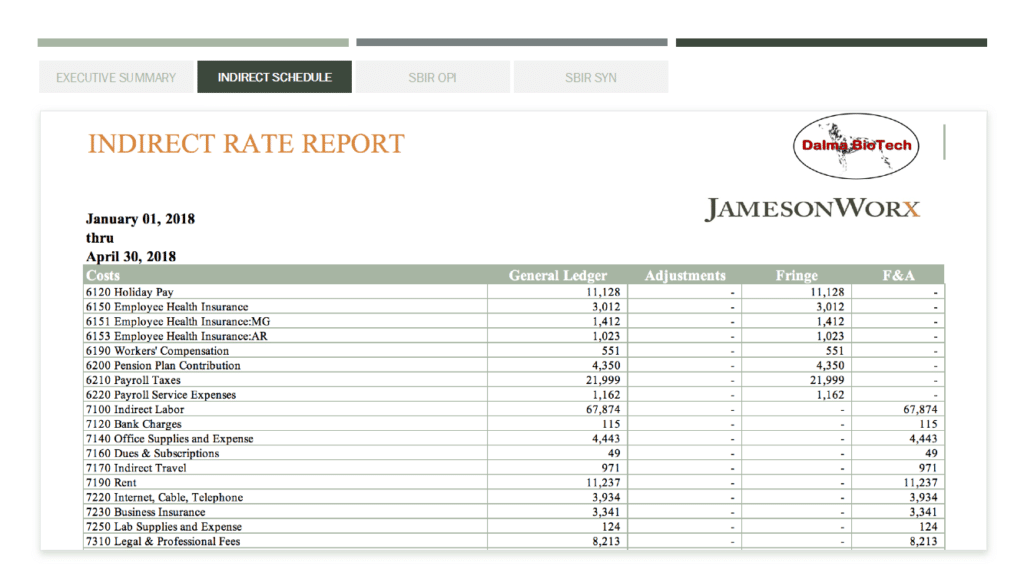

So as CPAs we’re Microsoft Excel freaks, right? Microsoft has this product called Power BI. We created a data model that connects Microsoft Power BI to your QuickBooks file to automatically populate an indirect cost rate report. On an ongoing basis, you can push a button and get an indirect rate report and a job cost report – on your PC, on your laptop, on your iPad or on your Android device.

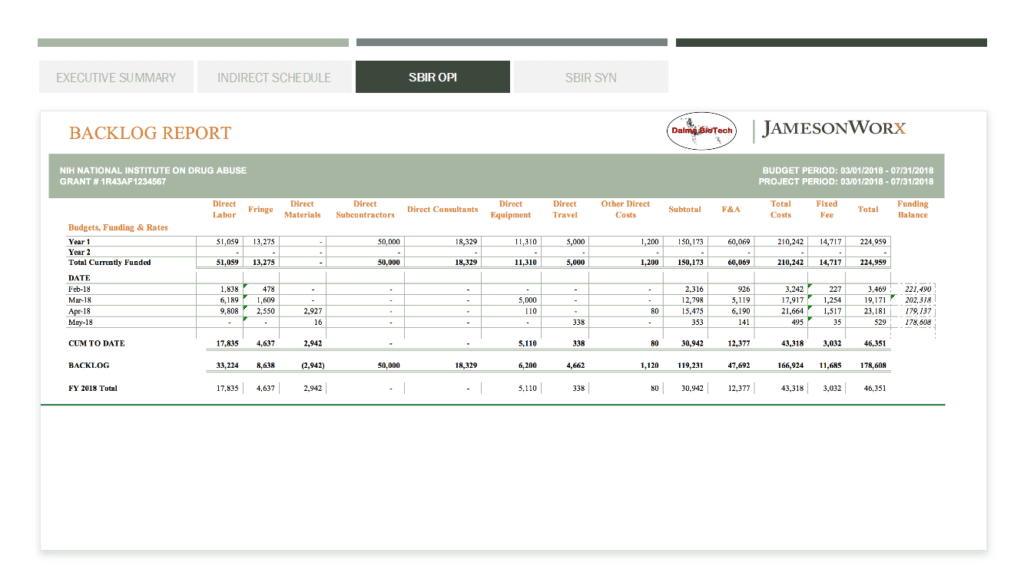

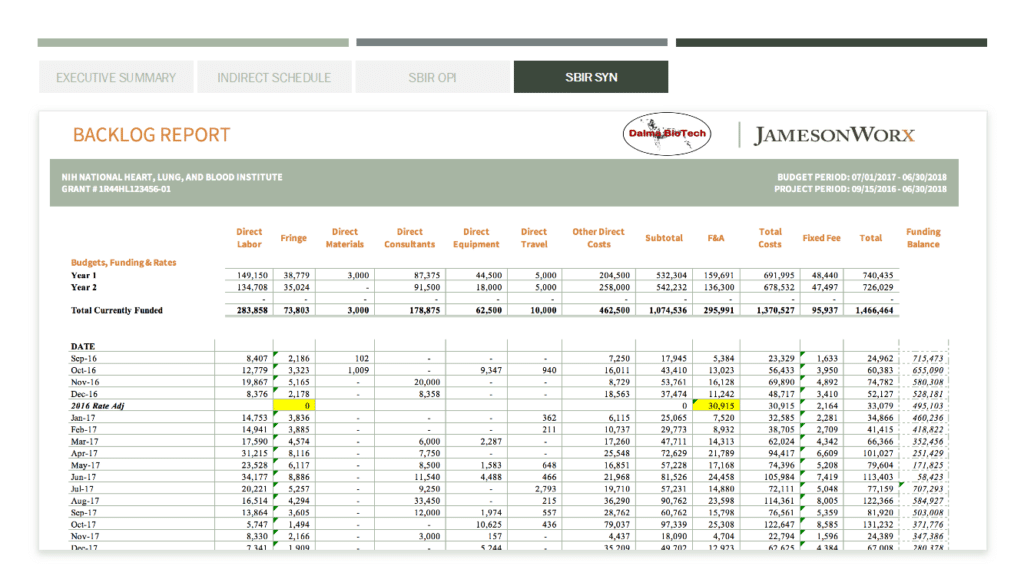

I want you to notice that in this JamesonWorx report – here is the budget for this client. Based on the values, you can see that this is their Phase I award. The report shows direct labor, the fringe benefits as provisionally proposed, subcontractor costs, consultant cost, direct equipment and direct travel costs as well as the F & A rate that they proposed, as well as the fee proposed.

You can see this JamesonWorx job cost report track costs against these budget categories. We can see our actual expenses by month against our budget and we can see how much backlog we have remaining to spend by budget category. In this case, we have a $224,000 award, we spent $46,000, we’ve got $178,000 to spend.

One of the other key things that we do in the JamesonWorx report at the end of the year is to calculate your actual indirect rate variance and post it to the job cost report – as required by the Federal Acquisition Regulations. In this example, in 2016, they hit their fringe benefit rate right on the money and they overran their F&A rate, so we’re allocating that overrun to all of the projects that they worked on for the year proportionally.

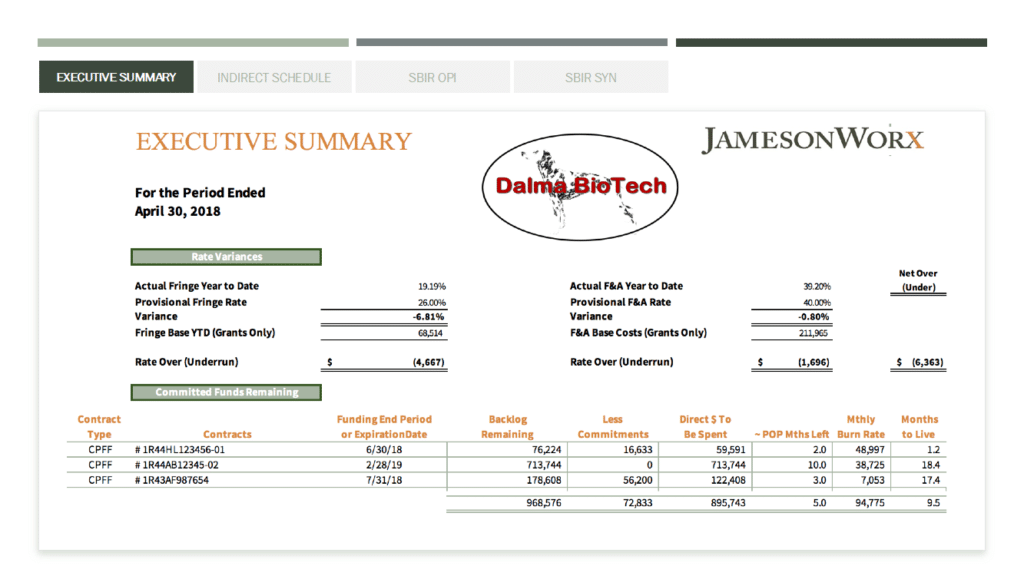

And for the executive who really doesn’t want to read detailed reports, we’ve got a nice executive summary page which shows the proposed 26% fringe benefit rate, vs the actual fringe benefit rate running at 19.19%, reflecting an underrunning of the fringe rate by $4,667. We also can see the F&A rate proposed at 40%, and actually running at 39.2, which is pretty close, but in total you can quickly see that you’re underrunning your overhead rates by $6,363.

This is incredibly important: With NSF, you cannot overrun your indirect cost rates without it coming out of your fee or out of your own pocket.

Down below, this client’s report shows three contracts or grants active. The report details the period of performance, when the funds expire, and how much they have in backlog remaining to spend.

We pull out subcontract commitments because it’s really not money you should feel free to spend because you’re contractually obligated to Johns Hopkins University or MIT or whomever. So this shows how much money you’ve effectively got left to spend internally and, based on the period of performance, this is how many months you have left. So based on the way you’re spending money, this is how many months you have “to live”.

It’s a really quick way to get a snapshot of how much money do I have left, how much time do I have. In some cases you’ll see, “Hey, we’re not spending the money fast enough. It looks like we’re going to need to file for a no-cost extension on at least one of these.”

HOW CAN JAMESON & COMPANY HELP NSF GRANTEES

So what does Jameson & Company do to help you? We have a number of different JamesonWorx solutions.

What I really want to point out is this: If we work with you during Phase I and you have issues, we can start to help you remedy those issues so that when you get into the CAP process we’ve got time to fix the problems.

You have several ways to work with Jameson regarding your government funding award accounting.

Basic: This is our lowest cost outsourcing solution. We set you up, train you and review your activity on a monthly basis, giving you a few key reports to track your job cost and indirect cost rate.

Corporate: Typically, if you have a bookkeeper or somebody who can process transactions fairly well, we would suggest a corporate package in which we oversee your monthly accounting.

Enterprise: This is for the people who would prefer to outsource their entire accounting department to us.

There are several benefits to outsourcing with Jameson. One, we’re highly experienced CPAs and we know government grant and contract accounting. Two, by outsourcing, you don’t have to hire people, pay benefits and so on. When you grow, we grow and if you shrink, we shrink – automatically.

Obviously, you want to make sure you budget these costs into your proposal so they get paid for through your indirect expenses.

THE CAP AND NSF ACCOUNTING PROCEDURES

In summary, the CAP process is an intense 10-day pass/fail audit, and I can’t emphasize this enough: Once they say go, you have to start jumping through hoops. This is NOT a good time to discover your accounting system isn’t set up correctly or you’re having solvency issues that we could’ve been working on weeks ago.

THE NSF & CONVERTIBLE DEBT

I’m going to tell you a little story, and I’m sad to tell you this is true: The federal government is not as advanced in their thinking as you’d like them to be. As an example, if anybody out there has investors who have signed on using convertible debt, let me explain from a tax perspective why you would want do that.

If I invest $200,000 in your company and you go bankrupt, I can take that $200,000 and write it off as a bad debt, a $200,000 expense in one year.

If your business does well, then I convert it to equity and your business becomes worth $100 million. I owe some percentage of that, and I now get a capital gains tax treatment.

This is a very common way for angel investors to invest in startup companies.

But the NSF sees this as $200,000 of debt, and their fear is they’re going to give you a $750,000 award and you’re going to pay off your debtors and you’re only going to spend $550,000 on the award. Therefore, you’re insolvent and you do not get the award.

As ridiculous as that may sound, that’s how NSF works.

PREPARE FOR A CAP AUDIT NOW, NOT LATER

The CAP process is a very intense. They audit your budget, they audit your FAR-compliant accounting system, and they want to see how you spent your Phase I money. They look at your financial capability.

If you start working with us now, we can start to identify where potential problems may be and start to remedy them. Once you get into this 10-day pass/fail audit period, it is incredibly difficult to start remedying these kinds of problems.

NSF FastLane reporting

Finally, the FastLane reporting. I mentioned earlier that the final cost report that you file is when you’ll find out that the government will suddenly ask you for $35,000 or $75,000 back – because you appear to have re-budgeted without permission or you re-budgeted from a direct cost category into an indirect cost category and you’re not allowed to do that.

It’s really important that you monitor your ongoing accounting activity and can demonstrate to them that you’ve spent the money properly.

Q & A WITH JAMESON & COMPANY

Q. For timesheet keeping, will QuickBooks’ time reporting function replace paper time cards filled out in ink?

A. QuickBooks doesn’t have a timesheet function. There are third-party software systems that you can buy that integrate and sync well with QuickBooks. Tsheets, Nexonia are two of the lower cost ones that we like because they sync pretty easily and they create the audit trail that the government’s looking for. Honestly, if you have less than five employees, it’s relatively easy to keep manual timesheets as long as those employees are not dispersed around the country. The more people are decentralized, the more an electronic timesheet makes sense.

On the higher end, Unanet and Deltek are great products. They’re just expensive.

In all cases, the key is filling out your timesheet on a daily basis in ink, signing it, your supervisor signing it and, if you’re changing it, you’re crossing it out, initialing it as opposed to erasing it. The government will never endorse a specific electronic timekeeping system, but your timesheet software must create a forensic trail that can demonstrate that it does what I just said.

Q. As a follow-up to that in regards to timesheets, can you fill out an Excel sheet and have the employees and supervisor sign them?

A. No, because you cannot prove that it was done on a daily basis, so you could’ve done it before the fact or you could’ve done it well after the fact. The government will not accept an Excel spreadsheet.

Q. The New Awardee Guide from January 2017 stated that 10% was the safe rate. But this contradicts the 50% safe rate seen in other materials.

A. That’s a great question. We saw that as well. There are a lot of dated materials, and the fact that that is dated January 2017 and has that information in it is disturbing. I will tell you that we’ve negotiated dozens of indirect cost rates with NSF and 50% is the safe rate. If you propose a rate of 50% or less, they will not question the rate.

It’s always safer from a financial perspective to ask for a 50% indirect rate and then re-budget out of that indirect rate into other direct cost budget categories. If you actually go through an indirect rate projection with us and you find out you need an indirect rate of 80%, we will request an 80% indirect rate in the proposal and when we go through the CAP process we will negotiate it on your behalf. It’s not a difficult thing to do if you’ve done a number of them. But the NSF will not settle for just a projection. They’re going to want to see some actual history. So when we’re looking at your Phase I award, we’re going to make sure that we get some support in your actual spending numbers.

Q. Regarding consultants; you mentioned the cap is $75 an hour. What if you have consultants that have a minimum rate of $325 per hour?

A. The extra $250 an hour is going to come out of your fee. It’s a really simple thing: They will not allow more than $75 an hour. In the past the NSF used to word it, “You can’t have a consultant charge more than $600 a day”. We had a lot of clever clients say, “just work two hours a day on my job at $300 an hour.” Now, the NSF added, “Oh, by the way, we consider $600 a day to be an eight-hour day.” When you do the math, that’s $75 an hour.

That’s part of the reason you must ask for that 7% fee, because that $49,000 is going to come in handy.

Q. Is General Commercial Liability insurance allowed in indirect expenses?

A. Commercial Product Liability insurance would not be. General Liability insurance is absolutely allowable. But if you have a commercial product, you cannot recover the cost of insuring. We do a lot of this with drug companies. That’s typically not an NSF-type issue, but General Liability insurance is absolutely an allowable indirect cost.

Q. What are the CAAR or CAP criteria for declining a grant proposal?

A. Number one is, and I’ll be frank – the technical proposal stinks. From an accounting perspective, it’s typically people don’t have an acceptable accounting system or they failed from financial solvency issues.

Q. What differentiates direct travel from indirect travel, and do I need to share how I spent the fee portion of our budget?

A. The second part of that question is easy. You can spend fee however you want. Spend it at a bar. Spend it on first-class travel. Take the money and put it in your bank account. You can do whatever you want with the fee.

The difference between a direct and an indirect expense, whether it’s travel or anything else, is if it weren’t for this project, would I have incurred this expense? And when you use this logic, you have to assume you have two or three awards. If I had three awards running and I had this expense, was it because of this one grant or did I need this to support the entire business? When you’re traveling to an NSF conference for your one NSF grant, you could see that as a direct travel charge. When you are flying around all over the place trying to drum up business, that’s really an indirect expense. Typically, people don’t travel unless there’s a reason for it, right? So if it weren’t for the grant, would I have incurred this expense? That’s really the litmus test that you have to ask yourself.

Q. Can time spent in administration, for example, accounting system, project planning, be used as indirect expenses?

A. Yes. One of the most common mistake people make is – when they write a proposal, all they think about the project. Then after they win the project, they’re running a business and there are accountants and lawyers to manage, employees and vendors to manage. This time really adds up. Indirect labor is one of the biggest expenses that most people underestimate. How about paying your employees not to show up to work 10% of the time? It’s called vacation, holiday and sick time. If you don’t plan for this time – it can really sink you!

Q. A re-budget of 10% is allowed for expenses not included in the original proposal. Is it the same percentage for expenses that were included in the original proposal? Or is this percentage higher?

A. I’m not sure that I completely understand the question, but let me explain the theory of re-budgeting to you. If you get a $750,000 Phase II – 10% of that is about $75,000. If you want to re-budget from direct materials to direct labor or from some direct category to another, you can move without permission. If you’re going to re-budget more than that, you have to go through the FastLane and request permission from your program administrator.

Q. One last question here about the Phase II process. Is it truly a pass/fail test? If they just submitted their paperwork package requested within the 10-day window, is it truly a pass/fail test, or will NSF ask for more information if it’s needed?

A. It is truly pass/fail.

Q. So they will not ask for additional information?

A. They’ll ask for clarifying information so they can to make a determination, but ultimately will either give you the award or not. If you can’t remedy a solvency issue or fail to have an acceptable accounting system, you’ll fail. They’ll just go to the next person in line.

Ready to Learn More? Speak With A Government Funding Award Expert!

Call Now: 781-862-5170 – or – Schedule A Call

Learn more about our FAR-compliant accounting system, JamesonWorx

Learn about our NSF grant accounting solutions.

The appearance of U.S. Department of Defense (DoD) visual information does not imply or constitute DoD endorsement.

I’ve been in practice for over 40 years helping our small business clients procure, manage, and survive audits on more than $6 billion in federal government contract and grant funding. We’ve been featured presenters and panel moderators at Tech Connect’s National SBIR/STTR conferences since 2010, and I’ve presented at the DOD’s Mentor Protégé Summit and present regularly for several state and local organizations.

GET THE SOLUTION YOU NEED NOW

Learn more about how we can support your needs and objectives. Join us for an enlightening discussion and take the first step towards a partnership that can make a difference.

JOIN OUR NEXT WEBINAR

Join us for an upcoming webinar where we’ll dive deep into the latest insights and strategies.

Reserve your spot today and take a step toward gaining valuable knowledge that can make a real impact.