How Do You Project an Indirect Cost Rate for a Phase II Cost Proposal?

We created the indirect rate video above from Ed Jameson’s talk about indirect cost rates and SBIR accounting at the National SBIR Conference. If you’re not able to watch it, here’s an overview with the key points you need to know.

How Jameson & Company helps clients project their indirect cost rate for a Phase II Cost Proposal

If you call us and say “I’d like you help us with our Phase II Cost Proposal,” we’re going to send you an Excel template with three tabs; a labor input screen, cost input screen, and a resulting indirect rate calculation output as the third tab.

Here’s how this works in the real world:

I’m Joe, and this is my company. I’m starting with a mentality of “I have a project, I want to keep my overhead rates as low as possible because I don’t know what I’ve got. I don’t know how the Peer Review Board is going to take my stuff. I’ve never proposed. I don’t have a priority score. I don’t have any feedback whatsoever to gauge how I’m doing. So I want to be as directly billable as possible.”

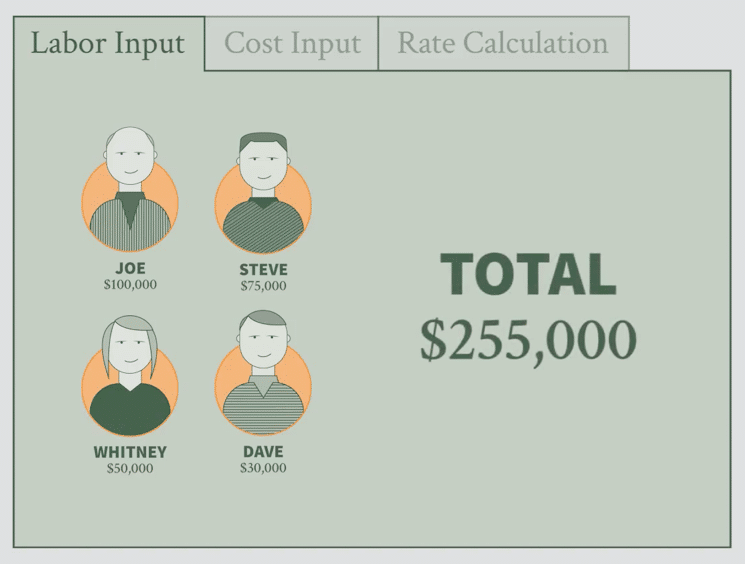

Tab 1: Labor input for an indirect cost rate projection

The first tab is all about your people. As the principal investigator. I want to pay myself $100,000 a year when we get the award because I think that’s a reasonable amount to pay myself. That’s what the market drives. Steve, my right-hand man will make $75,000 a year. I’ve got Whitney and Dave who are going to be technicians making $50,000 and $30,000 a year, respectively.

Tab 2: Costs input for an indirect cost rate projection

Payroll taxes get automatically calculated for you and then there are four sections. The top section is fringe benefits. Your mindset for whether something is a fringe benefit is “if it weren’t for hiring employees would I have this expense.” Some examples are workers comp, health insurance, dental insurance, pension plans, disability insurance, and things like that.

The next section is all my indirect expenses, let’s guestimate legal fees at $5,000 a year, office and computer supplies, $600 a month for telephone and telecommunication equipment, $3,000 a month for rent and $2,500 dollars a month for accounting and bookkeeping.

Then there’s all the direct expenses for all of our projects – materials, consultants, subcontractors and equipment.

The fourth section is the unallowable expenses.

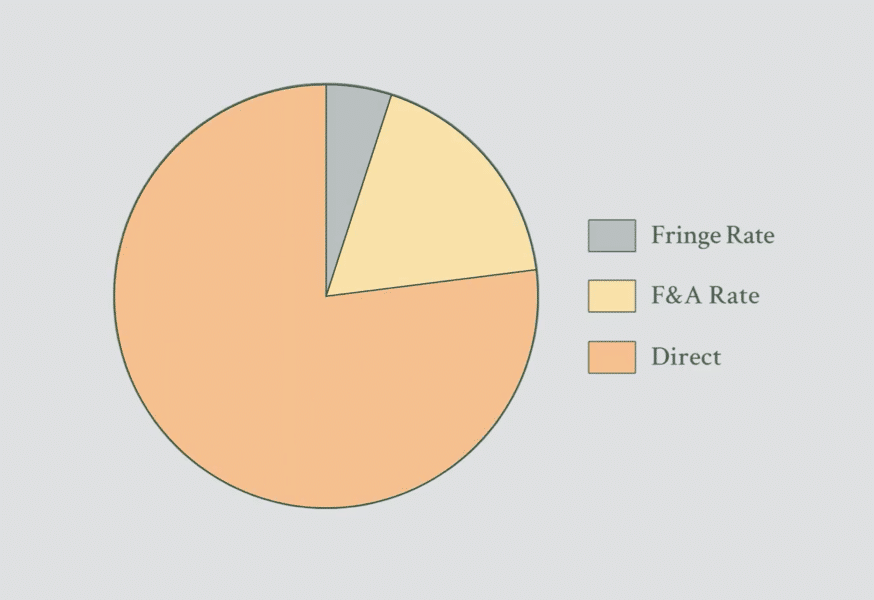

In this example, I have a 12.9% fringe rate and a 29.88% F&A rate.

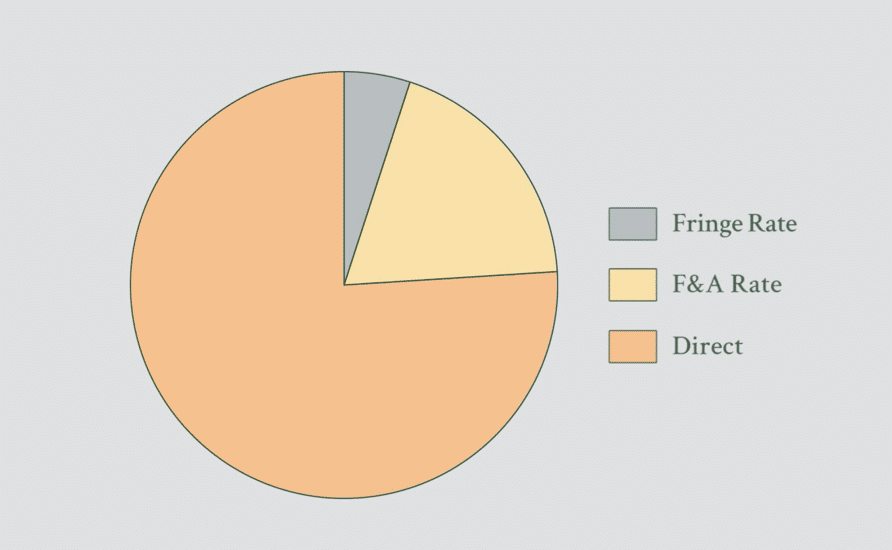

But what a happens when that office space I wanted isn’t available and the next best thing is $500 a month more? The resulting rate goes up a percent or so.

It’s not a big change because these expenses aren’t what really drive your indirect rate. The way your people charge their time is much more impactful!

Charging Indirect Labor vs. Direct Labor has an immense impact on your indirect cost rate.

Think about this: If you have an employee, you’re going to have to give them two weeks of vacation, ten holidays, and five sick days. So, 25 days a year, you’re going to have to pay somebody to not show up to work. So if there’s 2,000 hours in a year, 200 of which they’re not going to show up and they’re going to get paid, that’s about 10%.

Changing overhead for indirect labor: Working “in” vs. “on” the business.

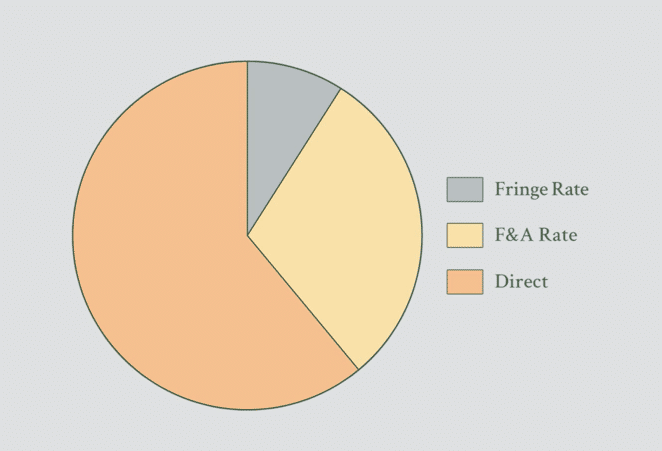

What if Joe, the business owner says to himself, “I’d really like to develop a business, but I don’t want to spend all of my time working in the project. I’d like to develop strategic alliances. I’d like to diversify the revenue stream. I’d like to do all sorts of things to develop the business. So I’d really like to spend 50% of my time on the project, and the rest of my time developing the business.

“In fact, Steve, my right-hand man, can also be very helpful working “on” the business, so I’m going to encourage him to spend some of his time helping me grow the business – writing proposals, making presentations, talking to potential subcontractors and stuff like that.”

The lower level technical folks like Whitney and Dave, are not going to help you build the business; they’re going to sit back in a shop and grind work away, right?

Now I haven’t change the money that I’m spending at all, but I’m changing the way I CHARGE for the expenses. And that results in a huge increase in the indirect rate. I now have a 25.4% fringe rate and a 58% F&A rate. Notice I didn’t spend money any differently. All I did was change the way I charged the expense!

How Your Expensive People Charge Their Time Drives Your Indirect Cost Rate.

So what drives indirect rates are the ways your expensive people charge their time. The minute you go from being in a garage with a couple of guys with an idea to becoming a business, you’ve got to start running things like a real business.

Get the indirect cost rate your business needs and deserves.

This is what we see all the time: 98.3% of all of our new clients come in, dramatically underestimating what their indirect expenses are. I had a guy come in with a bootstrapped business and he’s doing advanced crazy stuff in Silicon Valley and he’s proposing a 7% F&A rate.

Fortunately, his stuff was so good, that after he hired us, we went to his government agency, and talked about the value of his technology with his government customer. Then we explained that he didn’t know what he was doing when he came up with his indirect rate and that if we don’t fix it – he will put himself out of business. We let them know we’re going to fix it, and after 30 years of experience in this government award accounting, the agency knew we could and we would. And we did.

Get the help you need with your F & A rate or indirect cost rate.

At Jameson & Company, we are experts at helping our clients propose the right indirect cost rate, and we’ll even help you negotiate it. What’s more, through JamesonWorx, we offer an innovative SBIR-compliant accounting system that tracks your indirect rates to help eliminate surprises and pitfalls.

Ready to Get Started? Speak With A Government Funding Award Expert!

Call Now: 781-862-5170 – or – Schedule A Call

Learn more about our free indirect cost projection templates and free cost proposal review service!

Learn more about JamesonWorx Solutions.

This is the third of a five-part series about indirect rates.

- How The Wrong Indirect Rate Can Damage Your Business

- How to Project an Indirect Cost Rate

- How to Project an Indirect Cost Rate For a Phase II Proposal

- Real Life Examples of a Reasonable Indirect Cost Rate

- Understanding The Indirect Cost Rate Cycle

I’ve been in practice for over 40 years helping our small business clients procure, manage, and survive audits on more than $6 billion in federal government contract and grant funding. We’ve been featured presenters and panel moderators at Tech Connect’s National SBIR/STTR conferences since 2010, and I’ve presented at the DOD’s Mentor Protégé Summit and present regularly for several state and local organizations.

GET THE SOLUTION YOU NEED NOW

Learn more about how we can support your needs and objectives. Join us for an enlightening discussion and take the first step towards a partnership that can make a difference.

JOIN OUR NEXT WEBINAR

Join us for an upcoming webinar where we’ll dive deep into the latest insights and strategies.

Reserve your spot today and take a step toward gaining valuable knowledge that can make a real impact.