Why a FAR-compliant Job Cost Report is Critical to Your SBIR Award

If you are a Phase I awardee, you are in the midst of the Federal government’s proving grounds. This is your time to demonstrate that your idea is feasible. It’s also the time to prepare yourself for the rigors of government award accounting, and to gain and demonstrate the financial discipline you need to receive a Phase II award. A compliant job cost report is critical.

You must maintain your accounting system in accordance with Federal Acquisition Regulations (FAR) Part 31.

JOB COST REPORTS AND WHY THEY MATTER

Basically, your job cost report gives you a clear, complete picture of your project expenditures and shows how award monies were spent.

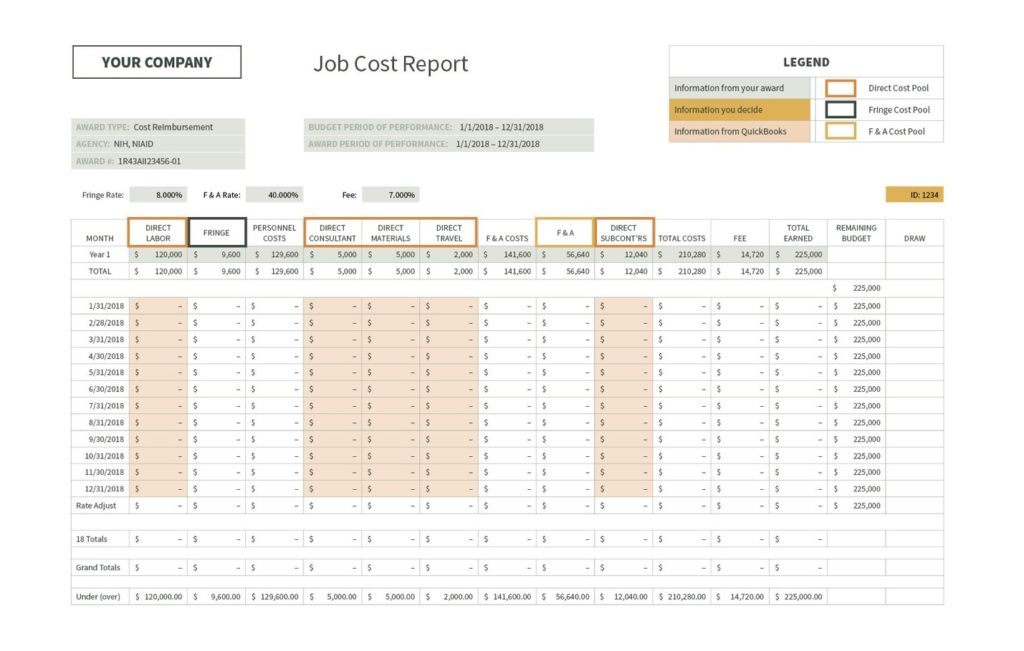

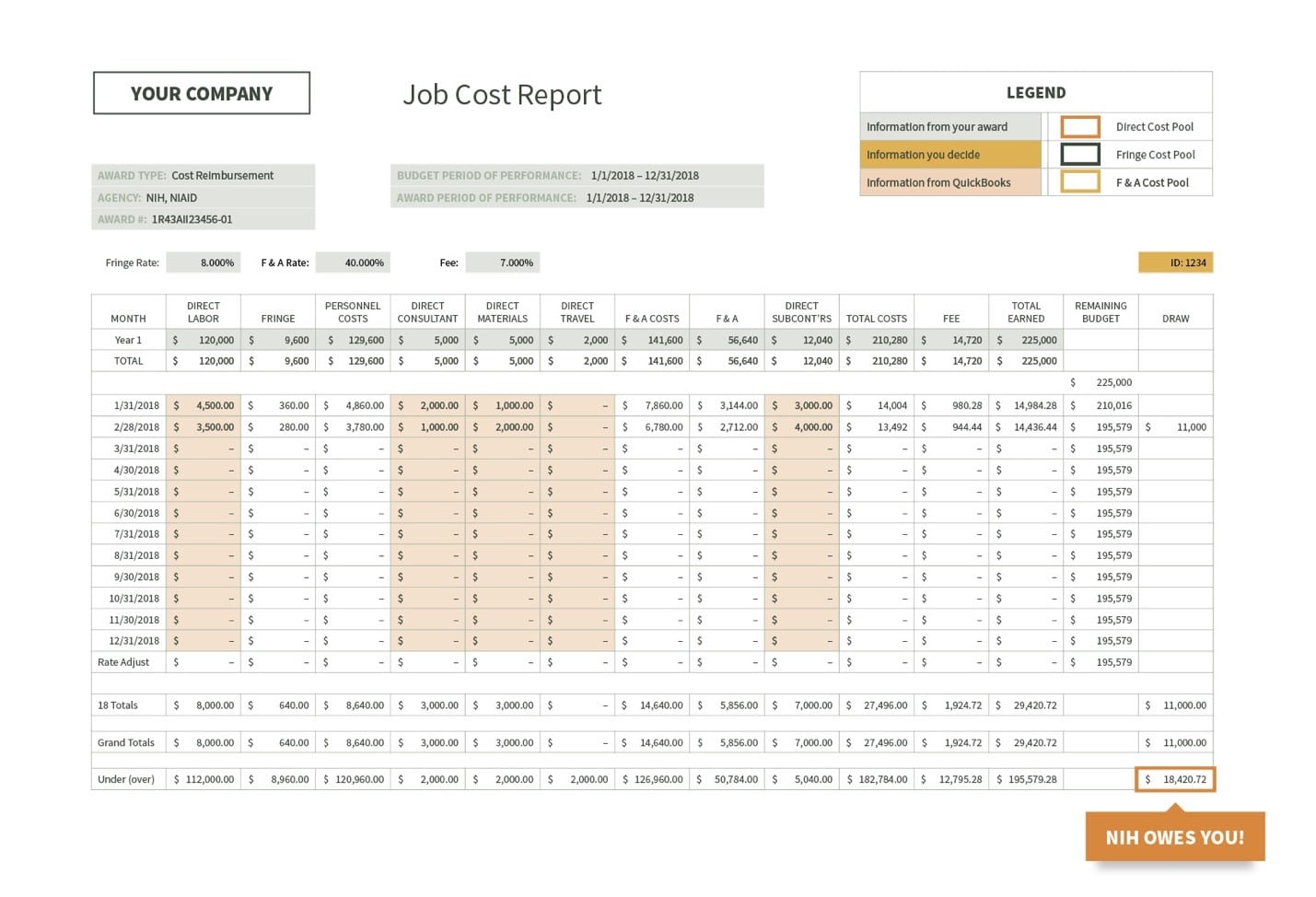

We’ve created a sample report to show you how it looks and works, and how it satisfies Federal government requirements. As you can see, we’re using an NIH award of $225,000 with a fringe benefit rate of 8%, a F&A rate of 40% and a fee of 7%.

TRACKING SPENDING BY COST CATEGORY

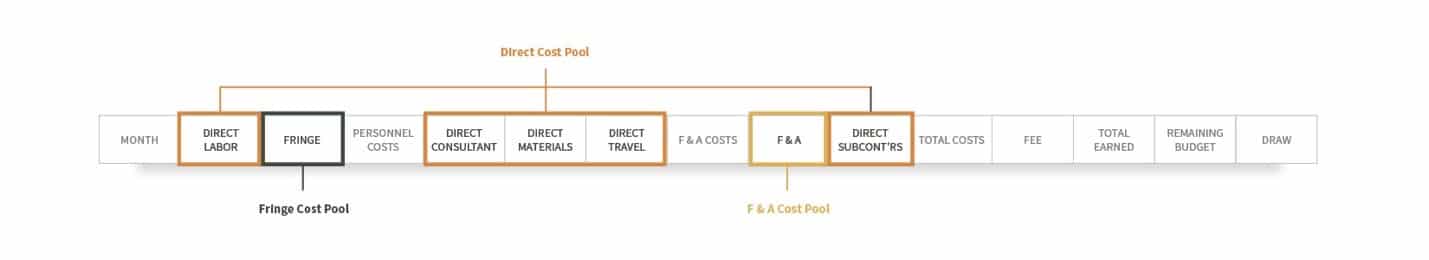

To be compliant with the FAR and avoid potential issues at audit, you must segregate your expenditures into three different cost pools: Direct, indirect (In this example, Fringe and F&A) and unallowable. It is critical that you keep your books in such a way that these cost pools are easily identified and should be maintained on a monthly basis.

Here is a close up of the columns in the job cost report shown above, Fig. 1, that demonstrates this.

DIRECT COSTS

You are required to accumulate your direct costs—specific costs that you’ve identified as solely benefitting this one particular project only. These costs are pulled directly from QuickBooks and are indicated by the blue-shaded sections.

INDIRECT COSTS (Fringe and F&A)

Next comes your indirect costs. These numbers are based on the indirect cost rates which may need to be approved by the Division of Financial Advisory Services (DFAS) and can be found in your award.

- Fringe is the cost of having employees: payroll taxes; vacation, holiday and sick time; medical benefits, and so on.

- F&A is Facilities & Administration: The costs required to run your business such as rent, telephone, utilities, accounting, HR, and legal services.

UNALLOWABLE COSTS do not appear on the job cost report. They are costs that the Government will not reimburse you for and are tracked separately in the general ledger.

THE JOB COST REPORT CALCULATES THE REVENUE EARNED EACH MONTH.

Once you’ve entered your Direct Costs in QuickBooks, your Fringe, F&A and Fee will calculate based on your award provisional rate. These numbers will be allocated to each job proportionate to their direct costs.

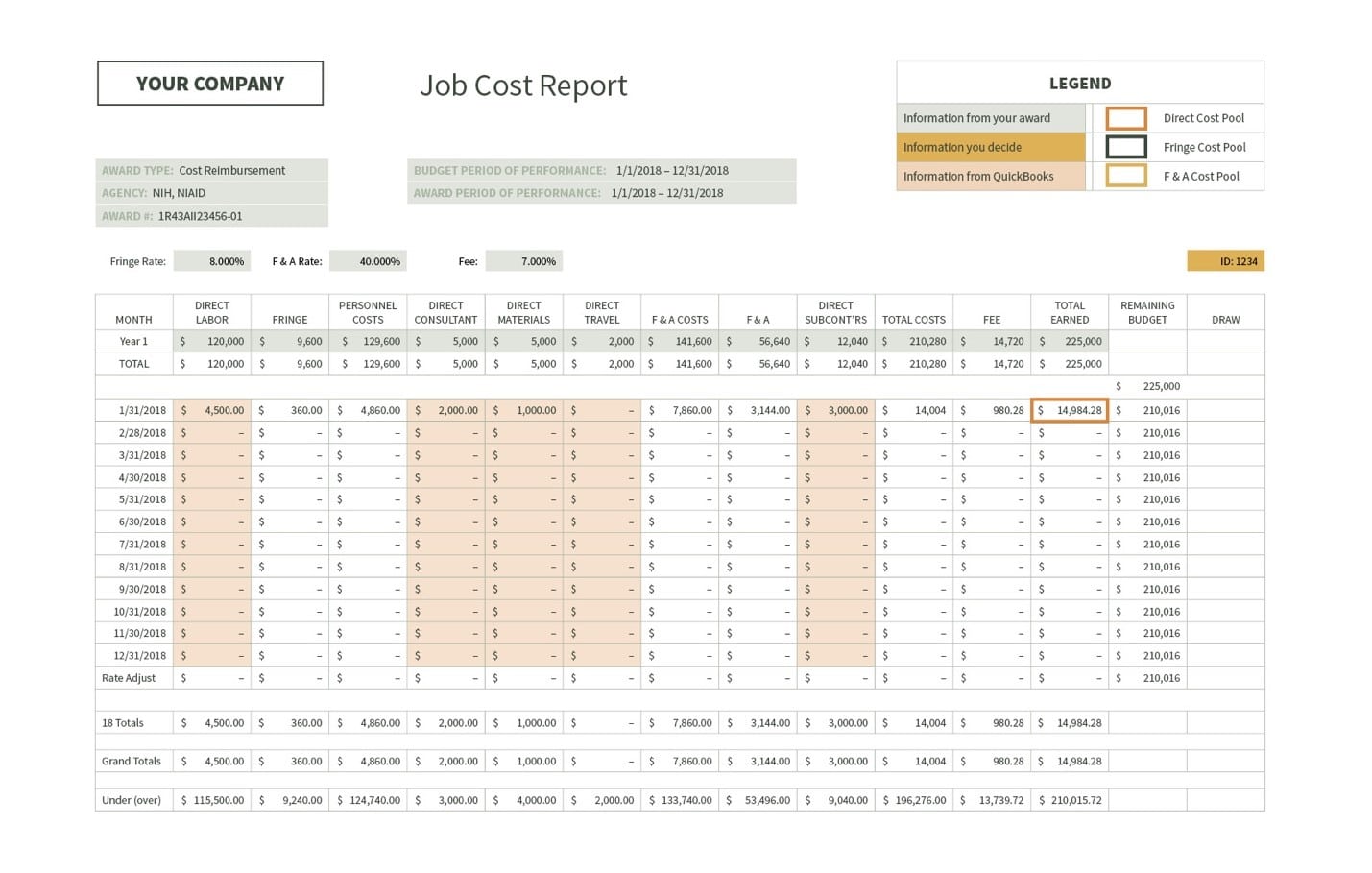

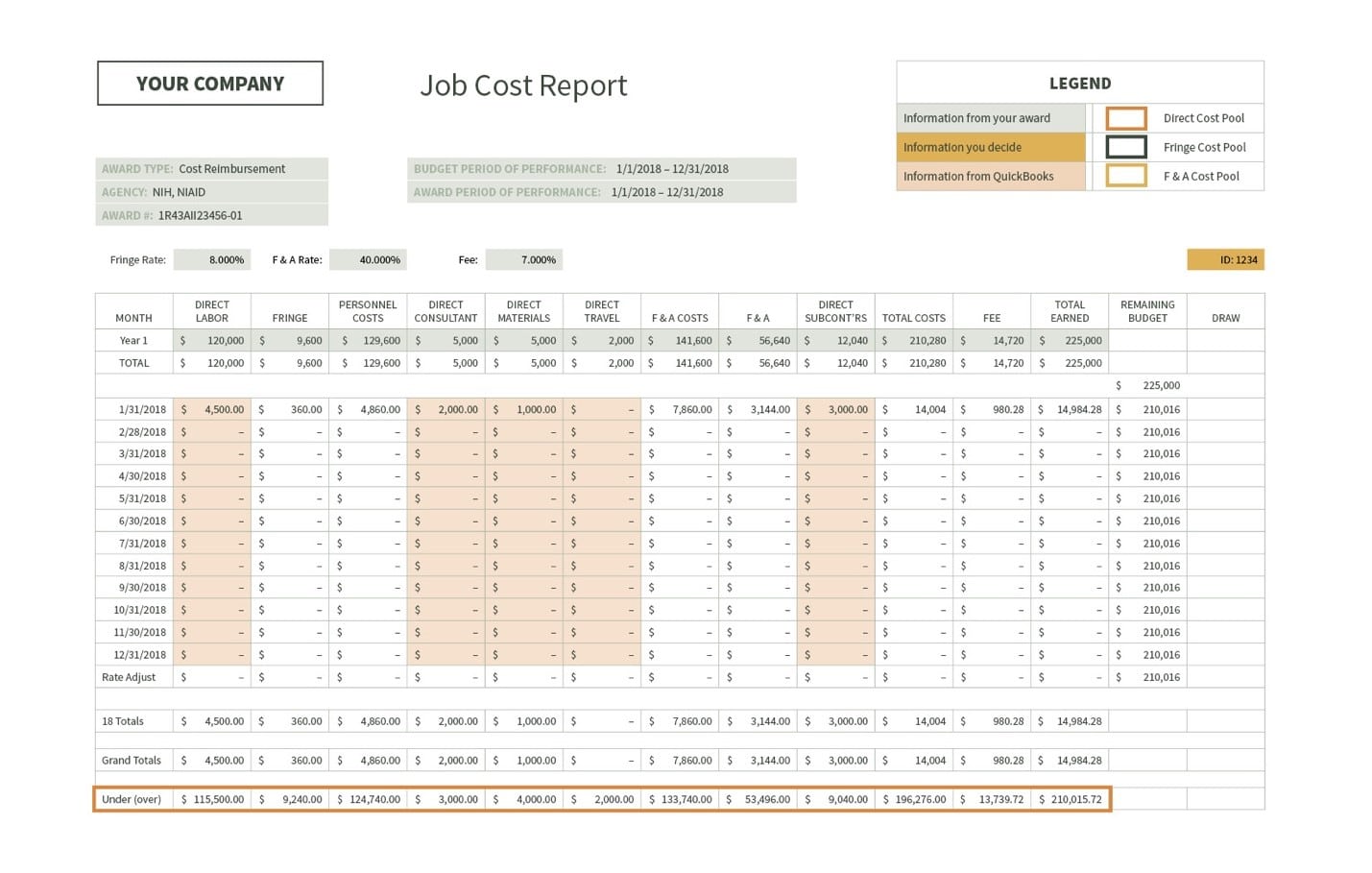

In the Job Cost Report above, you’ll see the following:

- Direct labor $4,500 + your 8% Fringe rate=$4,860. This is your total direct personnel costs.

- Add the other Direct costs which make up your F&A Costs Base (consultants, materials, travel) of $3,000 to get your F&A Costs Base of $7,860.

- Add your 40% F&A rate of $3,144 and your Direct Subcontractor costs of $3,000 to get your Total Costs of $14,004.

- Add your 7% fee of $980.28 and your total expenditures to get how much of your $225,000 award money you’ve earned: $14,984.28

THE JOB COST REPORT TRACKS ACTUAL SPENDING VS BUDGETED AMOUNTS IN YOUR AWARD.

When you submit your Phase I proposal, you give the NIH important budgetary projections, such as how much you would spend on direct labor, materials, consultants, subcontractors, and travel. You also allocate a fair and reasonable fringe benefit rate, F&A Rate, and fee. These projections are indicated in the Year 1 line.

Scroll down to the bottom of the following Job Cost Report, to the very last line, “Under/Over.” This clearly tells you if you are under or over your budgeted amount, and by how much. It also gives you a great way to track your spending and make critical adjustments as you progress through your Phase I award. Know that most government funding awards allow you to re-budget between direct cost-categories with limitations. You need to be familiar with this option.

USING THE JOB COST REPORT TO MONITOR THE AMOUNT EARNED AS COMPARED TO THE AMOUNT DRAWN.

In this example, you’ve earned $29,420.72 of your award monies, but you’ve only drawn $11,000. Therefore, at this stage in your NIH funding, you have underdrawn by $18,420.72.

ISSUES WITH OVERDRAWING AND UNDERDRAWING

ISSUES WITH OVERDRAWING AND UNDERDRAWING

Assuming you always draw for direct expenses, if your job cost report shows that you are over or under drawing, it’s most likely caused by a difference in your provisional fringe and/or F&A rate vs. your actual fringe and/or F&A costs.

In the example above, our NIH grantee has underdrawn on grant funds by $18,420.72. There may be a number of good reasons for this:

- They pre-paid for items and need to be reimbursed.

- They haven’t had the indirect expenses to draw down for yet, but they will.

- They are drawing for actual indirect expenses but have miscalculated their F & A rate and it’s actually running much lower than 40%.

Right now, our advice is to just keep an eye on it. If we see a pattern; if your rate is chronically high or low then we have to take action.

- If you are chronically underdrawn, then you need to re-budget from your F&A budget to your direct budget. There are constraints, so make sure you consult with an expert. At the end of the day, you want to spend all of your grant funds. Don’t leave money on the table.

- If you are chronically overdrawn and you do not have outside funding, then you have to get your expenditures under control. Otherwise, you will owe money to your funding agency for all overdrawn indirect expenses. Yes, the Federal government expects to be repaid for an overdraw of indirect expenses. Without an indirect rate agreement that says otherwise, you are not allowed to rebudget from a direct cost category to an indirect cost category.

YOUR JOB COST REPORT IS A MANAGEMENT TOOL FOR YOU AND THE AWARDING AGENCY.

For you to move on and receive Phase II funding, you must demonstrate to the awarding agency that you maintain a FAR Part 31 compliant accounting system. The job cost report is primary proof that you are ready for more fiscal responsibility.

If you can’t demonstrate a compliant job cost report, you’re telling them the exact opposite.

A word or two about our FAR-compliant accounting system, JamesonWorx.

JamesonWorx combines our government award accounting expertise, Microsoft BI and Quickbooks Online to create an affordable, FAR-compliant accounting system. This innovative, mobile friendly platform gives you instant visibility into your award wherever you may be.

JamesonWorx can create Job Cost Reports, as well as an actual Indirect Rate Report. There’s also an Executive Dashboard that provides key indicators, such as your actual indirect rate vs. your provisional indirect rate, whether you are over or under, your burn rate, and more.

I’ve been in practice for over 40 years helping our small business clients procure, manage, and survive audits on more than $6 billion in federal government contract and grant funding. We’ve been featured presenters and panel moderators at Tech Connect’s National SBIR/STTR conferences since 2010, and I’ve presented at the DOD’s Mentor Protégé Summit and present regularly for several state and local organizations.

GET THE SOLUTION YOU NEED NOW

Learn more about how we can support your needs and objectives. Join us for an enlightening discussion and take the first step towards a partnership that can make a difference.

JOIN OUR NEXT WEBINAR

Join us for an upcoming webinar where we’ll dive deep into the latest insights and strategies.

Reserve your spot today and take a step toward gaining valuable knowledge that can make a real impact.