Year End Tax Planning - The Tax Cuts and Jobs Act (TCJA)

TCJA means you need to re-examine business meals and entertainment coding.

When President Trump signed the TCJA into law late last year, the rules for deducting business meals and entertainment expenses for tax purposes changed beginning in 2018. This is important news for anyone who wants to stay in compliance with both the Internal Revenue Code and FAR Part 31.

This article discusses the changes in tax deductions and the necessity to modify record keeping practices in order to maintain an accurate and complete accounting of these expenses — your Chart of Accounts may need to be modified.

Whether you are a Phase I or Phase II grant or contract recipient, it’s most likely that client lunches, dinners and/or entertainment are part of growing your business. Please note that the “allowable cost” rules under FAR Part 31 have not changed and are different than the tax rules changes discussed below!

Overview of business meals and entertainment expenses

Basically, when it comes to client meals and entertainment, you should review all your 2018 spending and re-categorize each expense. We’ll go into greater detail about this in a bit.

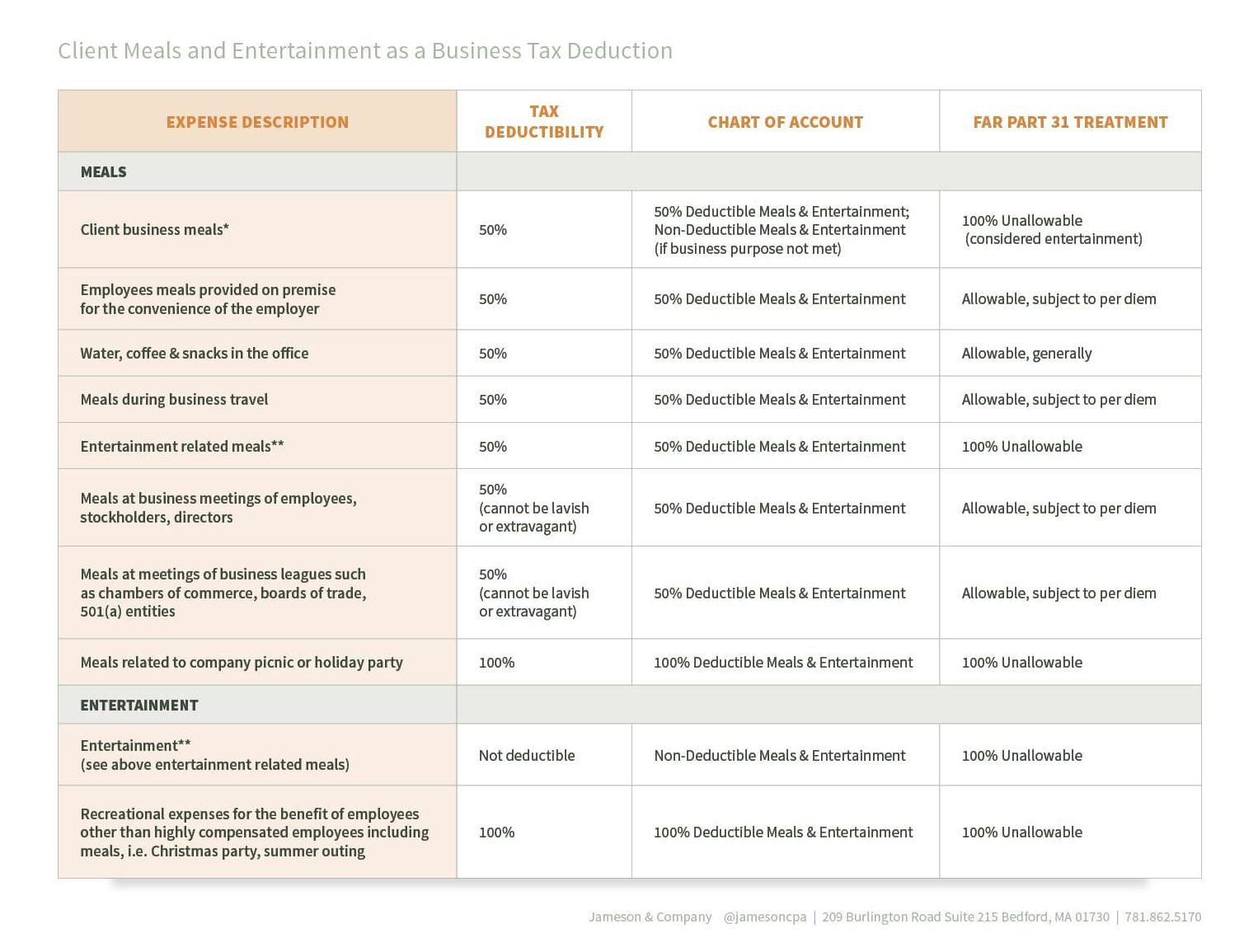

Client meals and entertainment as a business tax deduction.

There are basic criteria that must be met for be a tax-deductible client meal. Most are common sense:

- Take place between a business owner (taxpayer) and/or employee and a current or prospective client or business-related contact

- Not lavish or extravagant

- Business is discussed, and the taxpayer has a reasonable expectation of deriving income or other specific trade or business from the encounter

- You must be able to satisfy substantiation requirements, date, time, place, amount, business purpose, participants, supporting receipt

The cost calculated is based on reasonableness of expense or FAR Part 31 per diem allowances.

What is tax deductible client entertainment?

Business entertainment includes tickets to sporting events, private boxes at sporting events, theater tickets, club dues and memberships, and so on. In other words, any activity considered entertainment, an amusement, or recreation OR a facility used in connection with an activity.

To be considered client entertainment, the following criteria must be met:

- Expense is ordinary and necessary

- Not lavish or extravagant

- Taxpayer, or employee of the taxpayer, is present

- Food or beverage related to an entertainment activity needs to either be purchased separately, or separately stated from the cost of the entertainment

What the TCJA means to you

The Biggest Change: Under the TCJA, entertainment expenses that used to be 50% deductible are now 100% non-deductible.

What Hasn’t Changed: Client business meals that are 50% deductible for tax purposes.

To slightly confuse matters, the rules governing whether meals and entertainment costs are allowable under the FAR have not changed. For example, the maximum meal costs that can be claimed on government contracts are still subject to a per diem limitation. You can find these per diem rates at https://www.gsa.gov/travel/plan-book/per-diem-rates

What are the implications for your compliant government accounting system?

We would suggest the following additions to your Chart of Accounts to adequately keep track of deductible and non-deductible meals and entertainment costs:

- 50% Deductible Business Meals

- 100%

- Deductible Business Meals and Entertainment

- Non-Deductible Business Meals and Entertainment

You may need three levels of visibility into these new categories, as well.

- As a direct cost category

- As an indirect cost category

- As an unallowable expense category

To make it easier to navigate these complicated rules, we’ve created the following chart that provides the highlights of each type of spending category for allowable costs for tax purposes and in accordance with FAR Part 31:

** If the entertainment meets the criteria stated above.

We’re here to help.

Ready to learn more about this tax change, FAR Part 31 and how to stay compliant? Speak With A Government Funding Award Expert!

Call Now: 781-862-5170 – or – Schedule A Call

I’ve been in practice for over 40 years helping our small business clients procure, manage, and survive audits on more than $6 billion in federal government contract and grant funding. We’ve been featured presenters and panel moderators at Tech Connect’s National SBIR/STTR conferences since 2010, and I’ve presented at the DOD’s Mentor Protégé Summit and present regularly for several state and local organizations.

GET THE SOLUTION YOU NEED NOW

Learn more about how we can support your needs and objectives. Join us for an enlightening discussion and take the first step towards a partnership that can make a difference.

JOIN OUR NEXT WEBINAR

Join us for an upcoming webinar where we’ll dive deep into the latest insights and strategies.

Reserve your spot today and take a step toward gaining valuable knowledge that can make a real impact.